Trump advisor says US may take stakes in other firms after Intel

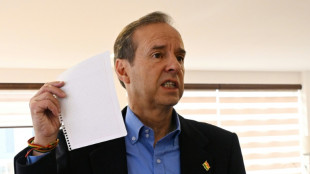

The US government could take stakes in other companies after doing so with chipmaker Intel, President Donald Trump's top economic advisor Kevin Hassett said Monday.

Hassett, director of the National Economic Council, cited Trump's plans for a sovereign wealth fund in a CNBC interview, saying "I'm sure that at some point there'll be more transactions" in the semiconductor industry or others.

He was responding to a question on whether a recently announced deal for the US government to take a 10-percent equity stake in Intel was the start of broader efforts towards similar moves in other industries that authorities have been funding.

Under the agreement with Intel, the US government will receive 433.3 million shares of common stock, representing a 9.9-percent stake in the company, Intel said in an earlier statement.

This amounts to an $8.9 billion investment, funded partially by $5.7 billion in grants awarded but not yet paid under the CHIPS and Science Act -- a major law passed under former president Joe Biden, which Trump has criticized. The other portion comes from a different award.

Hassett said on Monday that "in the past, the federal government has been giving money away" to companies.

But he maintained that under potential deals like that with Intel, "these are going to be shares that don't have voting rights."

He said the US government plans to stay out of how companies are run.

- Company risks -

Intel warned in a securities filing on Monday, however, that the government's equity stake could limit its ability to secure grants from government entities in the future -- among other risks.

It noted that the timing it would receive the funding, alongside its ability to fulfil conditions for the funds, "remain uncertain."

Intel additionally noted that its international business could be "adversely impacted" by the US government being a significant shareholder.

Critics of the deal warn it could be bad for the company's viability if politics are seen as driving business decisions.

In February, shortly after Trump returned to the presidency, the White House published a plan for the world's biggest economy to set up a sovereign wealth fund.

A sovereign wealth fund is a state-owned investment fund that manages a country's excess reserves, typically derived from natural resource revenues or trade surpluses, to generate long-term returns.

For now, Hassett noted that the specific deal with Intel came out of "a very, very special circumstance because of the massive amount of CHIPS act spending that was coming Intel's way."

bys/des

The US government could take stakes in other companies after doing so with chipmaker Intel, President Donald Trump's top economic advisor Kevin Hassett said Monday.

Hassett, director of the National Economic Council, cited Trump's plans for a sovereign wealth fund in a CNBC interview, saying "I'm sure that at some point there'll be more transactions" in the semiconductor industry or others.

He was responding to a question on whether a recently announced deal for the US government to take a 10-percent equity stake in Intel was the start of broader efforts towards similar moves in other industries that authorities have been funding.

Under the agreement with Intel, the US government will receive 433.3 million shares of common stock, representing a 9.9-percent stake in the company, Intel said in an earlier statement.

This amounts to an $8.9 billion investment, funded partially by $5.7 billion in grants awarded but not yet paid under the CHIPS and Science Act -- a major law passed under former president Joe Biden, which Trump has criticized. The other portion comes from a different award.

Hassett said on Monday that "in the past, the federal government has been giving money away" to companies.

But he maintained that under potential deals like that with Intel, "these are going to be shares that don't have voting rights."

He said the US government plans to stay out of how companies are run.

- Company risks -

Intel warned in a securities filing on Monday, however, that the government's equity stake could limit its ability to secure grants from government entities in the future -- among other risks.

It noted that the timing it would receive the funding, alongside its ability to fulfil conditions for the funds, "remain uncertain."

Intel additionally noted that its international business could be "adversely impacted" by the US government being a significant shareholder.

Critics of the deal warn it could be bad for the company's viability if politics are seen as driving business decisions.

In February, shortly after Trump returned to the presidency, the White House published a plan for the world's biggest economy to set up a sovereign wealth fund.

A sovereign wealth fund is a state-owned investment fund that manages a country's excess reserves, typically derived from natural resource revenues or trade surpluses, to generate long-term returns.

For now, Hassett noted that the specific deal with Intel came out of "a very, very special circumstance because of the massive amount of CHIPS act spending that was coming Intel's way."

I.Sperl--SbgTB